◄ Back to main feature, “Through a New Lens”

N.D.B. Connolly

Herbert Baxter Adams

Associate Professor

History

Q: What is redlining and where has it been practiced?

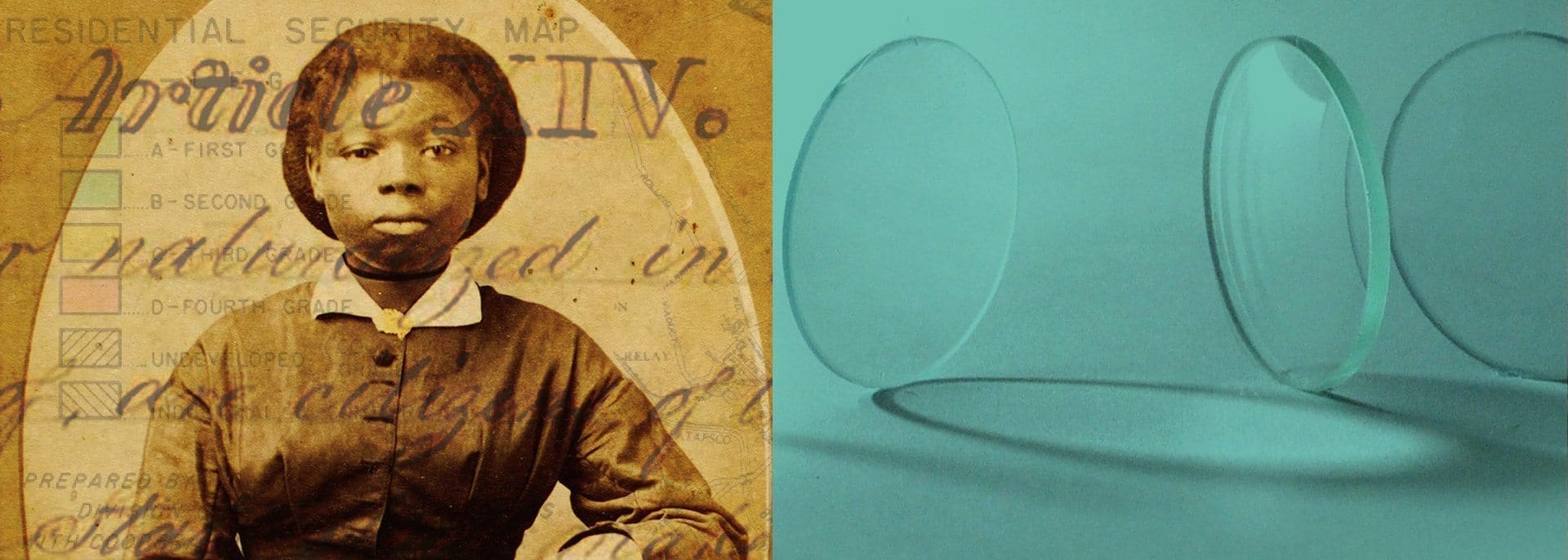

Redlining was the practice by which mortgage lenders, beginning in the 1930s, denied people access to home financing and federally insured mortgages on the basis of race, usually blackness. By controlling credit markets, lenders concentrated property ownership among white Americans and forced people of color to suffer either profiteering landlords or the most predatory forms of credit. Because housing remained as central to the 20th-century economy as slavery was to the 19th, some 250 major and mid-sized American cities have a documented history of redlining.

Q: Do any ramifications of redlining still exist?

Yes. Ignorance of redlining’s history generally leads one to confuse the causes of poverty with its consequences. The vast majority of African-Americans do not live in disadvantaged neighborhoods because they are poor. They are poor because, generation after generation, they’ve been forced to live in disadvantaged neighborhoods. This has remained true due to the relatively anemic enforcement of the Fair Housing Act of 1968, which was supposed to abolish all forms of housing discrimination. Existing wealth disparities between black and white people, disproportionate educational and health outcomes, differences in the racial experience of law enforcement, and even the residentially concentrated crunch of low wages and high interest rates (such as payday lenders) can all be traced to the afterlife of redlining.

This afterlife includes racist zoning practices, discriminatory housing code enforcement, uneven open-housing guidelines from state to state, racially skewed tax assessment, residential steering by realtors, and the targeted distribution of subprime mortgages through historically African-American institutions, such as black churches.

The most pressing questions, though, stand unchanged from nearly a century ago: Why do we allow poverty to be profitable, and what policy steps can we take to give people access to what federally insured mortgages first provided white Americans in the 1930s—safe housing, strong schools, paths to middle-income wages, and safeguards against calamities in one’s health or circumstance.

Connolly helped lead the effort to digitize records of redlining in the Mapping Inequality interactive database (bit.ly/mappinginequality).