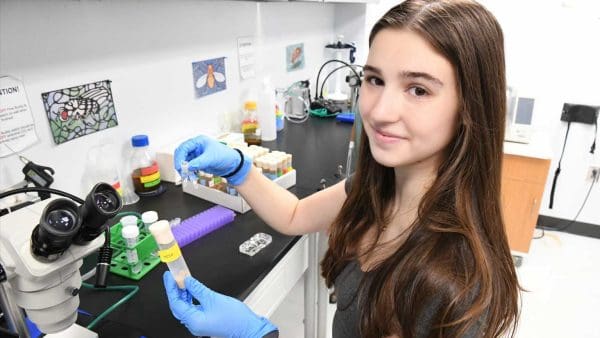

“We were literally just throwing medicine at people—‘Here, take it, and it’ll fix your problems’—but people would come back again and again with the same problems. We weren’t fixing anything.” That’s what Sminu Bose ’12 says about her first attempt at saving the world. As a freshman majoring in molecular and cellular biology, with a minor in entrepreneurship and management, she and 14 volunteers from Global Medical Brigades helped two local physicians set up health clinics in Honduras, where they saw 1,000 patients a day. It was a dramatic introduction to the problems plaguing global health care.

Bose, a recipient of a Woodrow Wilson research award, began thinking about how to change the lifestyle—and ultimately the health—of those patients. She returned to Honduras a year later with another group, this time to help the community establish a microfinance bank. This type of bank extends small loans to individuals, businesses, and organizations in low-income regions, including underdeveloped countries where small amounts of money can go a long way. “Give someone a loan to start a business,” she says, “and you’re hoping they’ll have a steady income, and they’ll be able to take care of health, education, and other needs.”

But despite their attempts to make the bank sustainable, the seed capital for these small-business loans was often given instead to friends and family for personal use. “It was a disappointment—to think ‘I’m going to save the world,’ and unfortunately things don’t turn out the way you want.”

Still determined to make a difference, Bose turned her attention to microhealth insurance, a new industry seeking to make insurance affordable for people living below the poverty line by providing them with low premiums. Her Woodrow Wilson fellowship enabled her to study those systems in Calcutta and Wayanad, India, and Phnom Penh, Cambodia—three areas chosen specifically for their differences.

In Cambodia, Bose found a bank-run system offering insurance to people who already had microloans; they were making some money but not very much. The poorest still had no insurance.

In India, the government subsidized premiums for those below the poverty level, though communication regarding the loan was often a challenge in big cities like Calcutta. Once past the hurdle of getting the word to large numbers of poor people, it was even tougher to convince them to pay money toward something that might happen.

Microinsurance was most successful in small villages like Wayanad, where women’s and family groups spread the word, and enrollment was high. But the facilities serving that population were too far away, so the benefits were mostly unused.

Praising Bose’s “dogged determination,” her adviser Eric Rice, senior lecturer at Johns Hopkins’ Center for Leadership Education, says, “She was able to compare lessons learned [painfully] in one location with emerging plans in another. Not only has she expanded her own knowledge, but also her efforts leave behind a richer range of experience available for other JHU students.”